From the Americas to Europe, Molson Coors has made premiumizing its global portfolio a key part of its Acceleration Plan.

Since 2019, the company has steadily grown above premium net sales revenue by more than 20%. And as Molson Coors executives shared at the company’s strategy day in October, the company aims for a third of its global brand revenue to come from the above premium price tier over the next several years.

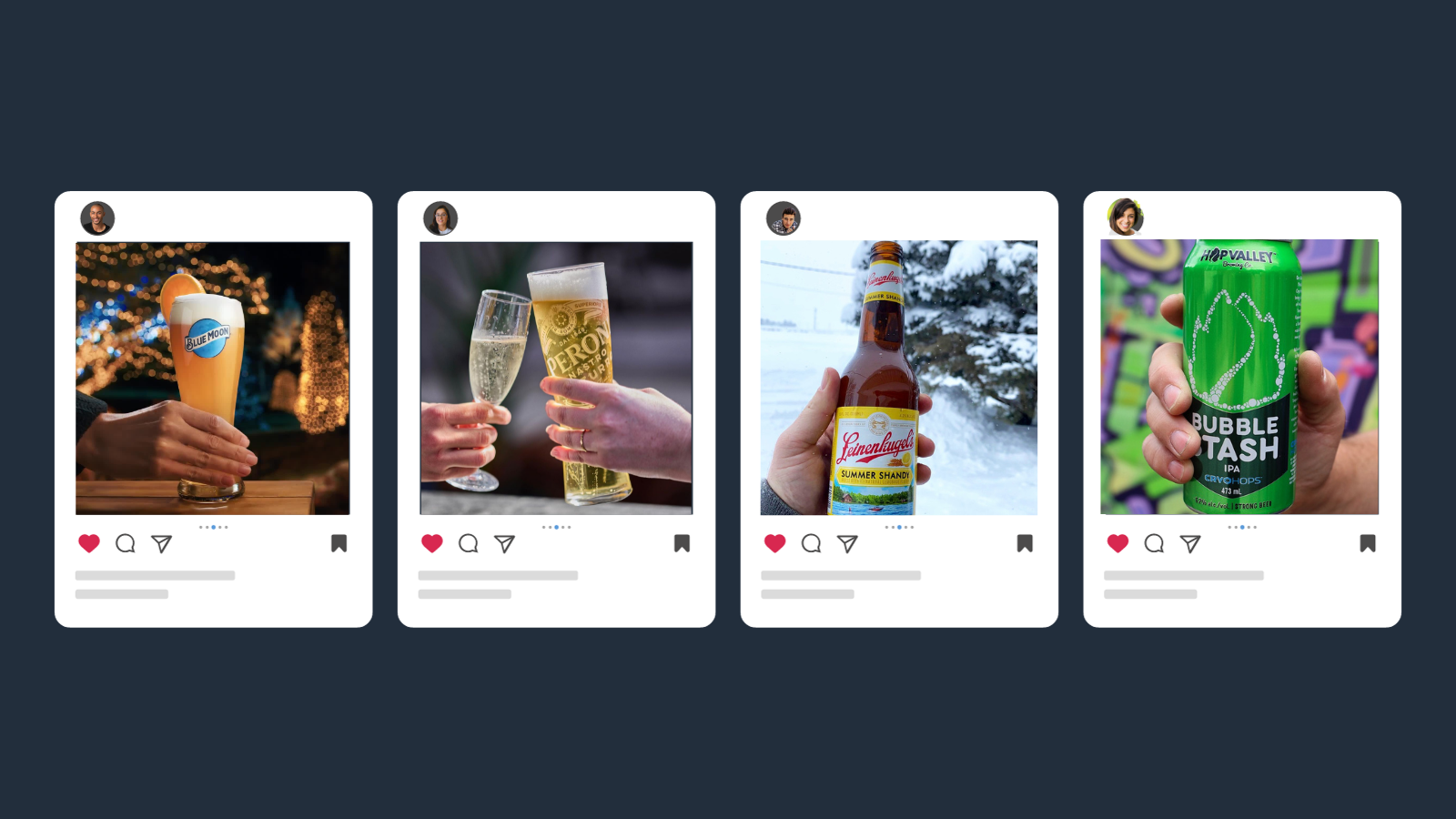

That goal bears out a core reason why Molson Coors is placing bets where it has the most to gain within the segment, and in the U.S., that means focusing on its flagship craft brand, Blue Moon, its red-hot European import, Peroni and its national craft brand, Leinenkugel’s.

“We have great plans to fire on every cylinder of above premium beer,” says Courtney Benedict, vice president of marketing for above premium beer.

“When you think about craft, we have the No. 1 craft brand in Blue Moon; the No. 1 light craft beer brand in Blue Moon LightSky, soon to be Blue Moon Light; the No. 1 craft summer seasonal in Leinenkugel’s Summer Shandy; regional craft breweries with on-trend styles and local relevance across four time zones; and the fastest-growing European import franchise in Peroni,” she says.

The above-premium push is led by Blue Moon, which is looking to bounce back in 2024 with fresh new packaging that unites the brand family, a rebranded Blue Moon Light, new Blue Moon Non-Alcoholic and an expanded “Made Brighter” marketing campaign. It’s also launching 19.2-ounce cans of Blue Moon Belgian White Belgian-style Wheat Ale and Blue Moon Light to appeal to craft consumers in convenience stores.

In the on-premise, where Blue Moon is the No. 2 tap handle in the U.S., it aims to continue the momentum that’s led it closing the gap with the top spot by 25% this year. And it’s looking to end 2023 strong with a push during the holidays.

“We see Blue Moon as a beer that can be part of that celebratory experience during the holidays. Consumers are purchasing something special and we’re working to make Blue Moon their premium beer choice,” says Natalia Zaldivar, associate marketing manager for the brand.

This year, Blue Moon is building off its successful Pie Pints program by releasing limited-edition Blue Moon Thanksgiving Seasoning, coming in two varieties that encompass its signature Valencia orange peel flavor: Zesty Seasoning and Pie Pint Seasoning. It’s also giving consumers the chance to buy four-packs of its popular mini Blue Moon-inspired pies: Zesty Pumpkin Spice Pie, Tangy Citrus Apple Twist Pie, Key Lime Coconut Crumble Pie, and Chocolate Citrus Haze Pie.

Building with Peroni

Peroni Nastro Azzuro, the fastest-growing European import franchise, is up about 7% overall year-to-date, according to Circana. In the on-premise, it’s up 2.7% in volume sales for the last 13 weeks – while key competitors Stella Artois and Heineken are down 5% and 7%, respectively, according to Nielsen data – with big ambitions to continue growing in 2024.

Its Peroni Nastro Azzurro 0.0% non-alcoholic beverage, which launched in February, will expand to new markets next year. And Peroni will continue to have a presence with Formula 1 racing, where Peroni 0.0% currently sponsors the Aston Martin Aramco Cognizant Formula 1 ® Team.

Both brands are entering an important period as above-premium beer competes against wine and spirits during the winter and holiday seasons. It’s proven to be a fruitful time of year for Blue Moon and Peroni, especially in the on-premise, where both brands stood out, growing both volume and dollar sales, according to Nielsen IQ data for the 13 weeks that ended Jan. 28, which encompassed the holiday season.

Year-round flavor with Leinie’s

Molson Coors is also looking to grow its Leinenkugel’s brand, coming off the heels of two strong years of Leinenkugel’s Juicy Peach and its “Flavor the Moment” campaign. In 2024, the company is focused on continuing that innovation focus in the Great Lakes Region: it’s introducing new Lakeside Cherry and it’s bringing back one of its most requested flavors, Grapefruit Shandy, after years of requests from consumers and distributors.

It recently released Leinenkugel’s Red Lager and will again offer drinkers a winter respite, with flagship Summer Shandy returning to shelves in January, when it’s consistently delivered higher-velocity sales than previous winter seasonals.

In looking towards 2024, Benedict says the Blue Moon-led portfolio is primed for trajectory change and will build upon the growth of Peroni and Leinenkugel’s to meet consumers’ needs in every dimension of above premium beer – from U.S. craft to European imports.

“We believe in these brands. We think we have the plans to not only grow them, but accelerate into 2024 and beyond,” she says.