In another attempt to revive its flagging flagship, Anheuser-Busch this year appears poised to bolt on another line extension to Bud Light called Bud Light Lemon Tea.

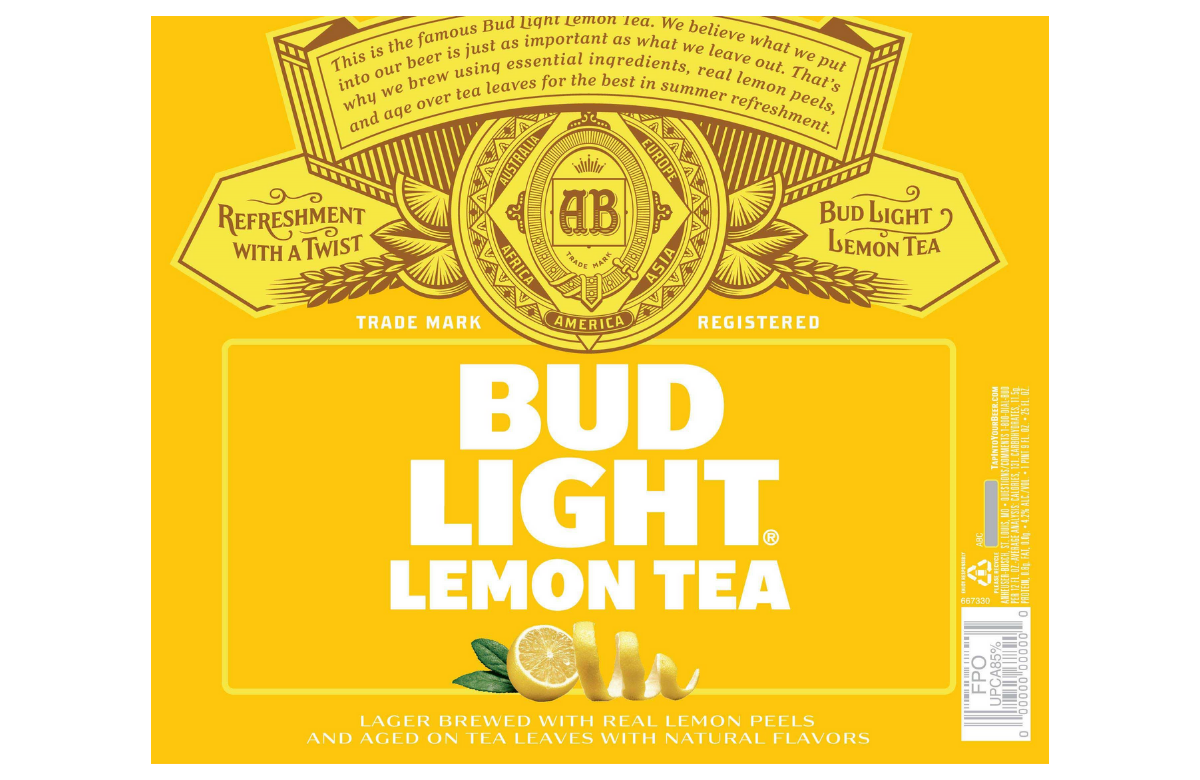

The brand this month gained federal approval for labels, which describe the beer as a “lager brewed with real lemon peels and aged on tea leaves with natural flavors.” Like flagship Bud Light and previous line extensions Bud Light Lime and Bud Light Orange, Bud Light Lemon Tea checks in at 4.2 percent alcohol by volume.

Thus far, it has approval from the federal Alcohol Tobacco Tax and Trade Bureau for 25-ounce cans and 12-ounce bottles. Anheuser-Busch lists all 12 of its U.S. breweries in its application.

An Anheuser-Busch spokeswoman declined to comment.

Should Bud Light release the new flavor, it would come a year after the launch of Bud Light Orange, a commercial success that ranked among the top new brands of 2018 as measured by volume.

Despite Bud Light Orange’s success, however, shipments of Bud Light dropped 6.7 percent in 2018, its largest percentage decline on record, according to Beer Marketer’s Insights. That marks the 10th consecutive year the top-selling beer has shed volume.

To get the brand back on track, Anheuser-Busch seems to be taking a two-pronged approach: continue filling its distribution pipeline with line extensions and go after its competitors, particularly the light lagers brewed by MillerCoors.

In a series of ads that aired during the Super Bowl, Bud Light attacked Miller Lite and Coors Light for using corn syrup during fermentation, which aids in making them light-bodied, easy-drinking beers with reduced calories and carbohydrates. None of these sugars are in the final product.

Bud Light also is plastering billboards and out-of-home advertising carrying similar messages around the country.

The attempted broadside prompted a withering rebuke from the nation’s farmers, agricultural concerns, some beer fans as well as from brewers, including MillerCoors.

Bud Light VP Andy Goeler explained to Ad Age’s E.J. Schultz that the brand aimed to bring “ingredient transparency” to the industry and elevate the standards. “As the lead brand in the industry this is something that’s good for beer. It’s good for us, the lead brand, to make a bold move like this.”

In the ads, Bud Light also took an unveiled shot at hop extracts, the soft resins and essential oils extracted from whole-cone hops using a CO2-based process that are used to flavor and add bittering to beer.

Curiously, Anheuser-Busch uses hop extracts in a range of its Bud Light line extensions, according to its website, including Bud Light Orange, Bud Light Lime, Bud Light Platinum and Bud Light Chelada Extra Lime. It’s unclear if Bud Light Lemon Tea will use them, though its labels say “We believe what we put into our beer is just as important as what we leave out. That’s why we brew using essential ingredients, real lemon peels and age over tea leaves for the best in summer refreshment.”

Industry analysts such as Wells Fargo Securities’ Bonnie Herzog suggest AB will continue to focus on innovation and “premiumizing” its portfolio, including investments into line extensions such as Bud Light Orange.

The near-term volume gain of extensions can be substantial. With Bud Light’s distribution, when it rolls out a line extension like Bud Light Orange “just the pipeline fill is bigger than 90 percent of craft companies in the country,” said Bud Light marketing chief Andy Goeler at a conference earlier this year. “You can get a lot of volume really quick.”

But at what cost? These types of line extensions risk muddying the positioning of two brands that once stood for simple, singular, easy-drinking American lagers, observers say.

But to Anheuser-Busch chief Michel Doukeris, these types of innovations are another way to get consumers talking about mainstream beers again, the first step to winning back volume. “Volume will follow brand performance,” he said, pointing to measures such as penetration, consideration and worth, according to Beer Marketer's Insights.

It’s an idea he’s been pushing for some time. Last year, for instance, he said Bud Light Orange and a reformulated Bud Light Lime added “a lot of excitement to this category and the entire industry. They’re bringing people to drink lager beers again.”

Whether that moves them into flagship Bud Light remains an open question. So far, however, the numbers don’t bear that out.

The MillerCoors Behind the Beer news blog is typically published three days a week. Subscribe here. Do you have story ideas? Questions? Comments? Email Peter Frost at [email protected].