Anheuser-Busch appears to be preparing to launch a new non-alcohol beer called Budweiser Zero, according to labels that passed through the Alcohol Tobacco Tax and Trade Bureau last week.

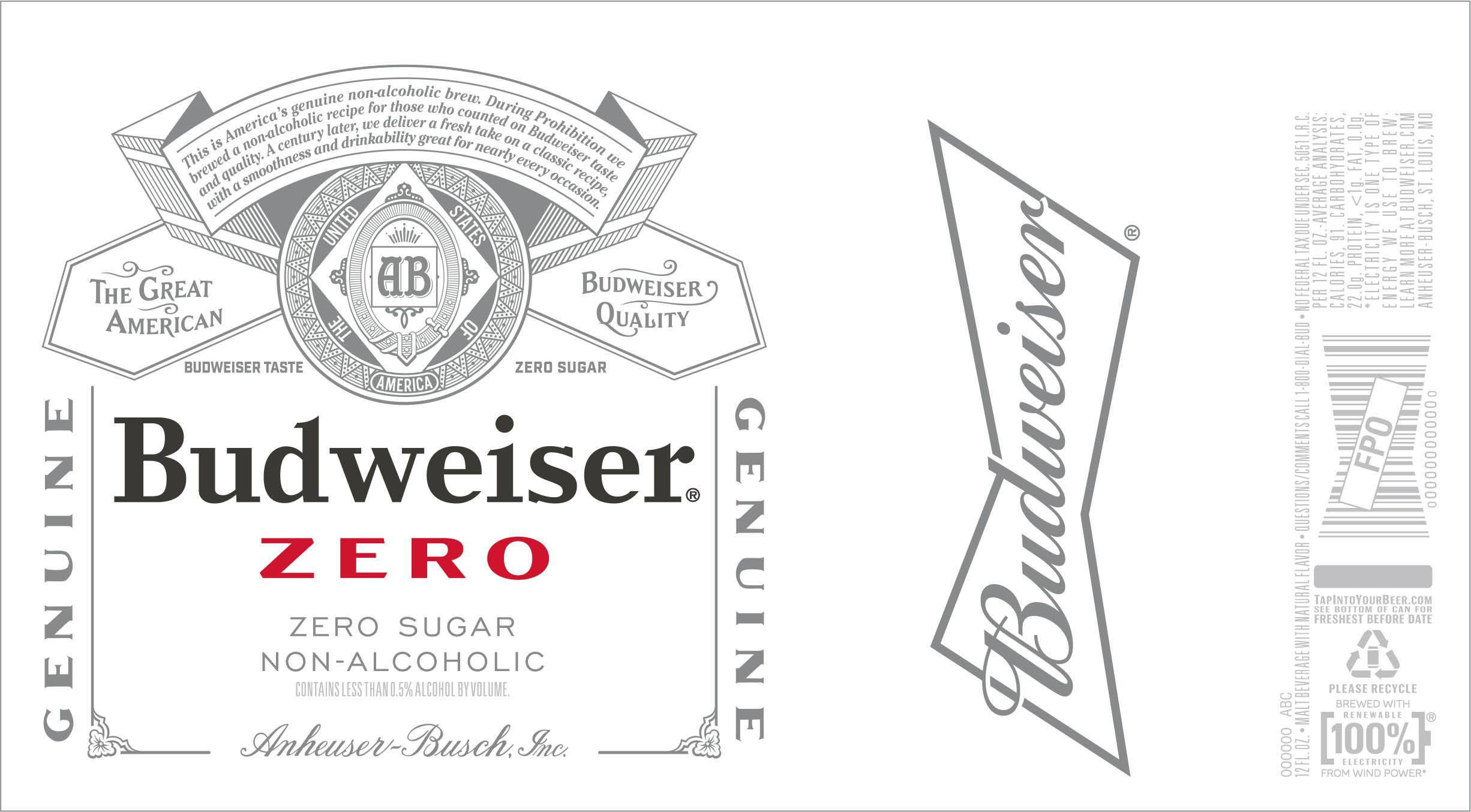

The beer, which proclaims it has “Budweiser taste” and “zero sugar” contains less than 0.5% alcohol by volume, per its labels. It will be packaged in stark white cans with a grayed-out Budweiser badge with “Budweiser” in black font and “ZERO” in red. It contains 91 calories and 22 grams of carbohydrates.

Its label reads: “This is America’s genuine non-alcoholic brew. During Prohibition we brewed a non-alcoholic recipe for those who counted on Budweiser taste and quality. A century later, we deliver a fresh take on a classic recipe, with a smoothness and drinkability great for nearly every occasion.”

The labels come after Anheuser-Busch tested another non-alc beer called Budweiser 0.0 in select U.S. markets. It’s unclear what will happen with that brand. AB also sells in the U.S. O’Douls, Busch NA, St. Pauli Girl NA and Beck’s NA.

An Anheuser-Busch spokesman did not respond to a request for comment.

The brewer and its global parent, Anheuser-Busch InBev, last year launched 12 new no- and low-alcohol beers. In total, such beers account for about 8% of the company’s global beer sales by volume, the company said earlier this year. AB-InBev has said its low or no-alcohol drinks (mostly energy drinks and non-alcohol beers) will make up 20% of production volume by 2025, up from around 10% today.

Budweiser Zero also comes amid a broader move toward low- and no-alc beers. MillerCoors, for example, said last month it plans in November to release Coors Edge, a new non-alcohol beer with the lowest calories and carbohydrates in its class, as part of an effort to reach drinkers migrating toward more low- and no-alcohol offerings.

With the launch of Coors Edge, which contains 41 calories, 8 grams of carbohydrates and less than 0.5% alcohol-by-volume, the brewer is taking another step in modernizing its portfolio of lower-alcohol beverages.

MillerCoors also last month relaunched 2.8%-ABV Miller64 as an “extra light beer” with a new look designed to appeal to health-conscious drinkers seeking lower-calorie options. And last summer MillerCoors parent Molson Coors acquired Clearly Kombucha, which makes six flavors of non-alcohol fermented tea beverages, and folded it into its U.S. craft and imports arm, Tenth and Blake.

Sales of non-alcohol beer are booming, up 8% in volume and 18.6% in sales dollars year-to-date through Aug. 24, according to Nielsen all-outlet and convenience data. That compares with +0.7% and +4.1% growth in regular beer, data show.

While the U.S. market for non-alcohol beer is just starting to show signs of life, the trend has been underway in Europe and Canada for the better part of a decade. Heineken, Anheuser-Busch InBev, Diageo and Molson Coors are bringing to market more low- and no-alcohol products globally.

Diageo’s Guinness last year introduced a new non-alcohol lager called Pure Brew in Ireland.

And Heineken early this year released its new non-alc entry, Heineken 0.0, in the U.S. and backed it with a hefty advertising budget. The beer, now sold in about 30 global markets, helped grow the company’s non-alcohol beer business by nearly 10% globally in its most recent quarter.