For a good stretch during hard seltzer’s explosive, out-of-nowhere ascent a few years back, the conventional wisdom in the beer industry was that hard seltzers were stealing drinkers who traditionally would have reached for premium light beer.

Over time, as more data has rolled in, a much clearer – and contrasting – picture has emerged, says Darien Grant, a Molson Coors category insights executive who studies convenience store trends.

“Premium lights and hard seltzers work together, growing basket size and bringing in new consumers,” she says. “Three-quarters of consumers buy across segments, and a third of premium light buyers also purchase hard seltzer.”

Premium lights drive more than 71% of legal-age drinkers’ trips to the store and are the top drivers of the amount drinkers spend per trip, their annual spend in stores and sales from features and displays, according to Nielsen and IRI data. Hard seltzers drive sales, too, but at a much lower rate than the workhorse premium lights, like Coors Light and Miller Lite.

Premium light beer drinkers are also more apt to pick up a case of hard seltzer on their trip, just as hard seltzer drinkers are inclined to add beer to their basket, Grant says.

“When premium light beer and hard seltzer are in the basket together, they have the highest spend of any segment,” she says. “Consumers are purchasing for different occasions, they’re buying across segments for occasions. But they’re not coming to buy one or the other.”

The opportunity for retailers? Bring ‘em in for premium lights or hard seltzer and send ‘em away with a case of both.

Grant and her shopper insights team poured through IRI and Nielsen data to uncover four insights from Molson Coors about how premium lights and hard seltzers work together.

Displays matter

It’s no secret that displays help sell beer. And when large (24 cans and up) and secondary packs (12 packs and under) of premium lights are on display, they grow dollar sales by a combined 38.8%, according to IRI data.

However, retailers may be leaving millions on the table by not giving premium lights the display space they deserve.

Premium lights make up a quarter of total beer volume, yet account for just 17% of displays, including just 10% dedicated to large packs, the analysis shows. Compare that to hard seltzers, a slowing segment that accounts for less than a tenth of total beer volume, but occupies 21% of display space.

If retailers dedicated the same amount of space for premium lights that they give to hard seltzers, they could realize a roughly $41 million opportunity with premium light large packs and a $17.7 million boost with secondary packs, according to IRI.

“Displays drive more purchases, especially for familiar brands,” Grant says.

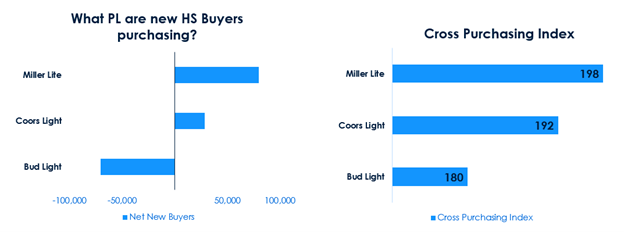

Coors Light, Miller Light drinkers cross-purchase

Coors Light and Miller Lite drinkers are loyal to their favorite beers – but they’ve also shown propensity to buy across segments, more so than other major brands.

“This is what we mean when we say every segment plays a role. Three-quarters of beer buyers buy across segments. One-third of premium light buyers also purchase seltzers,” says Grant. “Retailers can build on drinkers’ brand loyalty.”

Coors Light, Miller Lite attract new seltzer drinkers

Beer drinkers aren’t the only ones shopping across segments. New hard seltzer drinkers are, too.

In fact, new hard seltzer drinkers are substantially more likely to pick up a case of Miller Lite or Coors Light than Bud Light, Molson Coors analysis of data show.

“This goes to show it’s not an either/or scenario,” Grant says.

Sell the occasion

It may seem obvious that occasions matter for drinkers, but there’s untapped opportunity for retailers to appeal to customers who are buying for specific occasions, Grant says.

“There’s a great opportunity to hype cross purchasing for occasion. If they’re getting seltzer, it’s for pool day, or premium lights for unwinding after work,” she says. “They want to try both.

“Eighty percent of shoppers don’t leave the beer aisle, so there’s an opportunity to showcase the variety of products that work together,” she says.

Grant says it all goes back to securing displays and promotional activity to drive more trips, spark reminder and unplanned purchases.