Anheuser-Busch InBev plans to launch in the U.S. this spring Bocanegra, a Mexican craft beer brand it acquired in 2016 that so far has only been sold in its home country.

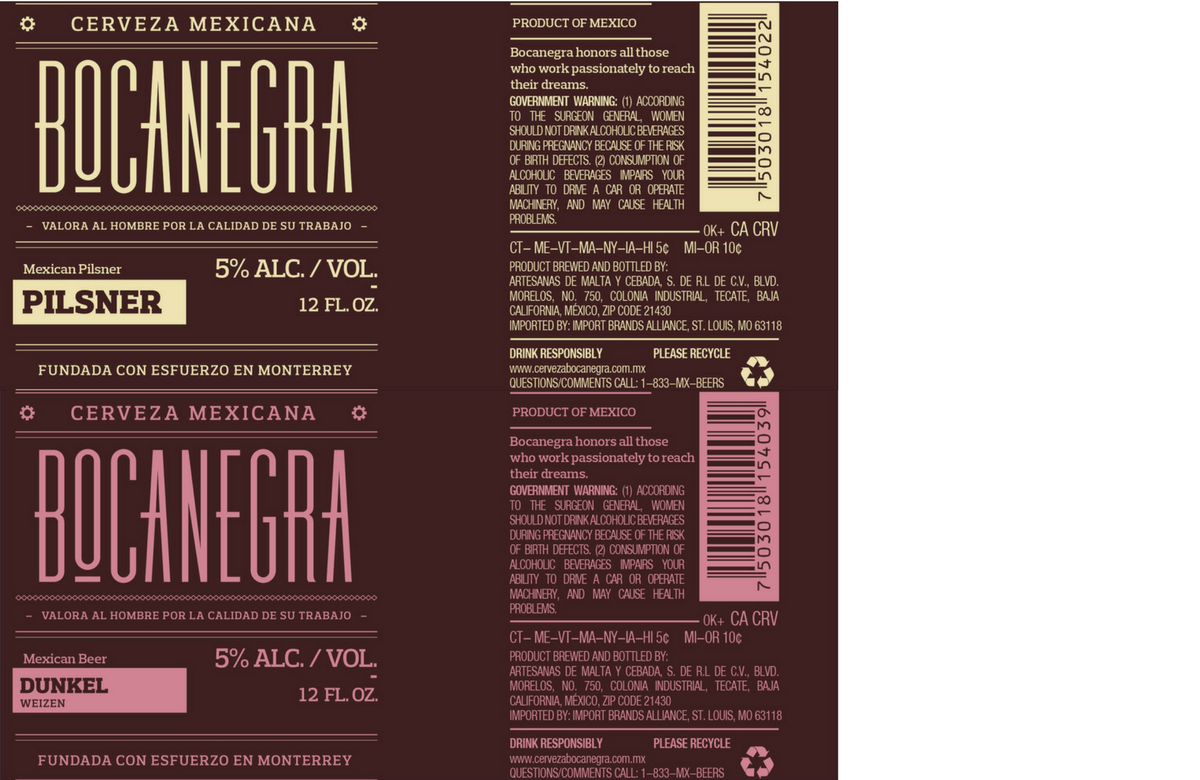

Bocanegra, which a spokesman says will debut in New York City and Los Angeles, got federal approval in February for labels of Bocanegra Pilsner and Bocanegra Dunkel Weizen in the U.S. Both beers have 5 percent alcohol-by-volume and will be sold in 12-ounce bottles and on draft.

Bocanegra’s bottles are primarily in Spanish. The front of the label includes the phrase: “valora al hombre por la calidad de su trabajo,” which translates to “value man for the quality of his work.”

The brand is part of the craft portfolio within ABI’s ZX Ventures division, which contains the company’s international craft and specialty beers. It will be imported by St. Louis-based ABI subsidiary Import Brands Alliance, the unit that also imports Stella Artois, Estrella Jalisco and Leffe, among other brands.

Founded in Monterrey in 2012, Bocanegra was acquired as part of ABI’s Mexican shopping spree of 2015 and 2016, which also netted the breweries Cucapa, Tijuana and Mexicali, according to Forbes.

Anheuser-Busch has not said whether it will expand distribution outside of its two launch markets in the U.S., but the company this year has said it plans a major investment in another Mexican import, the more mass-market Estrella Jalisco. Its moves with Mexican brands come as the market for Mexican imports continues to flourish.

Imports as a whole are up 6.3 percent in sales year-to-date, fueled by Mexican brands families such as Modelo and Corona, according to Nielsen all-outlet and convenience data through March 31. Modelo, in particular, is on fire, up 19.4 percent in sales dollars on a 16.3 rise in volume, per Nielsen. Corona, meanwhile, is up 8.4 percent in sales dollars and 6.4 percent in volume as a franchise, with a slowdown of Corona Extra and a dip into negative territory for Corona Light offset by gains of Corona Familiar and Corona Premier.

MillerCoors brand Sol, which relaunched this month with a new marketing campaign and updated packaging, is starting to gain momentum, up 29.2 percent in sales dollars on a 11.7 surge in volume over the four weeks ended March 31, bringing sales dollars to flat for the year, per Nielsen.